Valeriy Makovetskiy: How Foxtrot pays taxes and teaches Ukrainians how to control the state

Valeriy Makovetskiy and Gennady Vykhodtsev are co-founders and leaders of the Foxtrot Group of Companies who have not only created a brand with a 25-year history, but have also set the example to Ukrainian businesses as a responsible taxpayer.

The contents of the article

1. How does Foxtrot pay taxes?

2. How to educate a conscious taxpayer

Society keenly reacts to the word "taxes." Taxes in Ukraine is a specific irritant. Those who perhaps evade paying a compulsory financial charge to the national budget are noticeably outraged by a rate of income tax, value added tax and other types of levy. Those who regularly pay taxes show keen interest in how the money is spent.

At the same time, everyone is aware of the role taxes play in filling state coffers. They are needed to build a state, to support socially vulnerable citizens. In some countries, paying taxes is not only a duty, but also an honor: for example, the right to vote in Denmark is exercised by taxpayers only.

How does Foxtrot pay taxes?

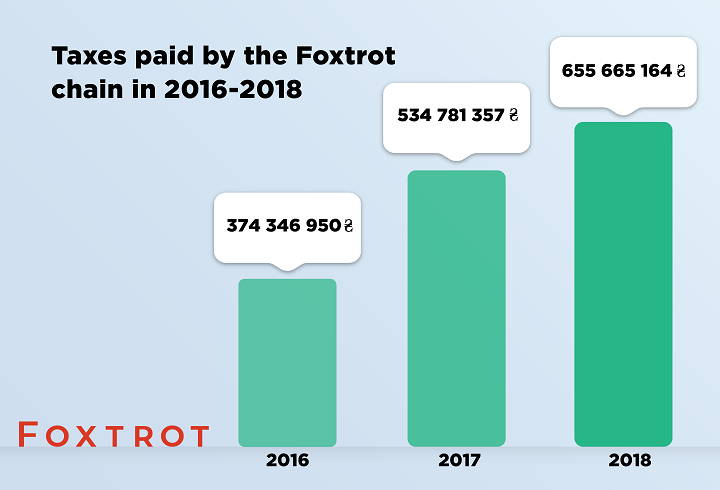

Attention! In 2018, the Foxtrot Group of Companies (FGC) paid UAH 655 665 164,06 in taxes to the national budget. In 2017, the Foxtrot Group's tax payment totaled UAH 534 781 357,00. As one can see, the amount paid in 2018 exceeded the sum in 2017 by 22,60%.

About Foxtrot

Foxtrot is one of Ukraine's largest chains of stores selling electronics and household appliances. In 2019, Foxtrot celebrates its 25th anniversary. It has been estimated that 27.8 million Ukrainians visited Foxtrot's retail outlets in 2018. The Foxtrot network consists of 162 stores in 90 towns and cities in Ukraine. This is an omnichannel brand: online commerce is organized on the Internet at foxtrot.com.ua with up to 8 million visitors in peak months. Almost the same number of customers – 8.2 million people – are active members of the Fox Club, Foxtrot's loyalty program. According to the results of 2018, Foxtrot was recognized as Ukraine's largest seller of household appliances and electronics – the country's first retailer in this market segment and ranked 72nd in the TOP 100 Ukrainian companies (published by ekonomika ). The Foxtrot brand in 2018 topped the Ukrainian State Fiscal Service's rating of sectoral employers, and in 2019 it is among the three most expensive brands in Ukraine according to the Korrespondent magazine (along with Kyivstar and TM Morshynska), the Business magazine's TOP 5 retailers and Delovaya Stolitsa's TOP 20 eco-brands of Ukraine.

Top managers of the Foxtrot Group – Gennady Vykhodtsev and Valeriy Makovetskiy – are also its founders. In addition to the popular brand Foxtrot, they develop the Secunda retail brand of watches, the DEPO't Center shopping malls and the Fantasy Town entertainment centers.

In 2018, the beneficiaries of the Foxtrot Group of Companies became media partners of the educational project "The Price of the State." The full name of the project is "Explaining the Cost of Public Services to the Voters." It is implemented by the Center for Social and Economic Research CASE Ukraine and Pact, in partnership with the Anti-Corruption Action Center, as part of the ENGAGE! Civic Engagement Program. It is funded by the United States Agency for International Development (USAID).

CASE Ukraine experts estimated that the UAH 655 665 164,06 paid by companies of Foxtrot's chain to the national budget in 2018 under the supervision of Chairman of the Supervisory Board Valeriy Makovetskiy would be enough for one of the following actions enhancing Ukraine as a state:

● To buy 300 B-type ambulance vehicles with equipment;

● To train 8,000 students at institutions of higher learning of the III or IV accreditation levels (maintenance costs, payment of lecturers' fees, teaching aids);

● To pay 244,000 presidential scholarships;

● To pay 51,000 social scholarships to students of educational institutions of I–IV accreditation levels during the year.

Important! The brands developed by the Foxtrot Group of Companies entered the TOP 200 employers in Ukraine in 2018. The list was compiled by the State Fiscal Service of Ukraine available at rating.zone. Rated were industrial, banking and commercial enterprises of Ukraine, which have the maximum number of employees and pay wages and salaries higher than the minimum level. State-owned and municipal enterprises financed from the national budget were not included.

Chairman of Foxtrot's Supervisory Board Valerii Makovetskii commented on the statistics and the place of the business in the country's key business ratings as follows:

"An increase in taxes from Foxtrot is our contribution to the strengthening of the state of Ukraine. This is about the law-abiding brand and its leadership in social behavior. In the consumer electronics market, where the share of the shadow sector sometimes reaches 90%, this is an example of a company's civic position in the development of a win-win strategy."

Reference note

A win-win strategy suggests mutual benefits built on understanding of both parties' interests. In addition to a win-win option, there are others: win-lose, lose-win, and lose-lose.

What is a correlation between the win-win strategy and UAH 655 665 164,06, which was paid by the Foxtrot network's enterprises to the budget in 2018? Development and stronger businesses contribute to the growth of the domestic economy. This, in turn, improves citizens' well-being. Thus, Foxtrot will have buyers. People will buy home appliances and electronics. And Foxtrot will routinely send part of the money earned to state coffers. Taxes will again go to the strengthening of the state, social benefits, salaries of state employees. Foxtrot will receive new customers; the business will be growing along with economic growth. All participants in the interaction process win.

Reference note. Who is Valerii Semenovych Makovetskii?

Valerii Makovetskii's Biography

Education

● Born on February 15, 1961, in the city of Taldykorgan, known as Taldy-Kurgan. Today it is Almaty Region, the Republic of Kazakhstan.

● In 1978, Valeriy Makovetskiy finished secondary school No. 9 near the Kommunarsk passenger and freight station. This is the northern part of the city of Alchevsk, which adjoins the Alchevsk Metallurgical Combine.

● 1984 – graduated from Kommunarsk Mining and Metallurgical Institute, the Department of Mechanical Engineering, a degree with honors. Now it is Donbas State Technical University.

Career

● 1981 – worked at Kommunarsk Metallurgical Plant, Alchevsk;

● 1983 – worked at Melitopol-based October 23rd Machine-Tool Plant as a lathe operator;

● 1985 – senior foreman at an engineering workshop of Kyiv Artem Production Amalgamation. Today it is state-owned Joint-Stock Holding Company Artem.

Entrepreneurship

● 1994 – Valerii Makovetskii founded a business based on wholesale of home appliances and electronics.

● 1996 – developed a retail network together with partners, including Gennadiy Vykhodtsev, to sell household appliances and electronics;

● 1997 – focused on retail sales of household appliances and electronics under the Foxtrot brand in the regions of Ukraine;

● Since 2004, Valerii Makovetskii has been developing the Foxtrot Group of Companies.

And this is what Valeriy Makovetskiy says about the value of money paid by businesspeople to Ukraine's national budget:

"There are countries where taxes are higher than in Ukraine. Take the countries in the north of Europe – Sweden, Norway, Denmark. Taxes are much higher there. But it is not the rate of taxes that is important, the important thing is that everyone should be on an equal footing. If you understand that your taxes go for a good cause, for roads, the army, state workers' payments, the reformed police, infrastructure development of the state, then everyone, and even opponents of taxes, will pay them. It is important to understand that taxes are spent in the right way."

Important! Being a conscious taxpayer is one of the business principles that Foxtrot has been adhering to for 25 years. At the same time, the situation in the country is unhealthy when the electronics market alone sees up to 90% of equipment of certain brands (for example, Apple) sold by sellers from the shadow segment without paying taxes. "There is a business that competes with smart solutions by offering services that win customer loyalty, an interesting marketing strategy, a well-built management system, but there are those who are interested in buyers at the cost of unpaid or underpaid taxes. Their point of growth is exclusively a 'corrupt rent.' But I believe in changing the situation; this can be done if the political will exists and there is a change in the values of the population," Valeriy Makovetskiy says.

Over the 25 years, the Foxtrot Group of Companies has formed the following values:

1. Leadership. All companies developed by the Foxtrot Group are moving in one direction. Leaders are Valeriy Makovetskiy and Gennady Vykhodtsev. The general task is to find the best solutions for business development. The result is the possibility of achieving personal goals by each member of the team.

2. Responsibility. All companies whose progress is supervised by the Foxtrot Group have a responsible approach to the service they offer to the consumer. The result of such an attitude towards their tasks is a constant increase in business standards for themselves and for the industry, positive changes in society.

3. Development. The Foxtrot Group of Companies and the brands that it develops invest time and money in the development of employees. The Group sees a guarantee of its own prosperity in their professional growth. Employees of the brands find self-realization not only in work, but also in voluntary self-organization.

4. Rationality. All the activities of the company are based on pragmatism and math-based estimation. Not only short-term profit, but also long-term prospects are taken into account.

5. Commitment. All members of the Foxtrot Group's team – the founders and employees – work as a single result-oriented system. Shared values and direction are an excellent basis for achieving the personal goals of each person and a point of business growth.

How to educate a conscious taxpayer

In 2018, Foxtrot became a partner of the Price of the State project, which sets a goal to explain to the citizens of Ukraine where the taxes they pay are spent on. It explains how the country's budget is formed; what funds are spent on pensions and other social benefits. But this "public budgeting" has moved away from the traditional boring, canonical forms. Instead, a digital calculator, educational videos, visualization of budget-forming processes are available on the website of NGO CASE Ukraine, which has been developing the Price of the State (cost.ua) project. As the organizers of the project said, the most difficult task was to encourage people to visit their website and give them information.

In 2018, Foxtrot was actively popularizing knowledge about the principles of filling the budget and calculating pensions among its customers. Some 170,000 envelopes with conditional bills for public services were distributed within three months thanks to Foxtrot's channels of communication with customers and the support of Valeriy Makovetskiy and Gennady Vykhodtsev. Some 250,000 customers watched a video about ways to fill the budget and the role of ordinary citizens in this process. Foxtrot's retail outlets in 90 towns and cities across Ukraine were involved in this project. Summing up, the organizers of the educational project said: 200,000 Internet users were invited to the Price of the State website in 2018. Some 200,000 Ukrainians learned how much education and medicine, law enforcement agencies and the army, culture and environmental protection cost them personally (as taxpayers).

The educational campaign conducted by CASE Ukraine, Foxtrot and other partners was conducive to shaping law-abiding taxpayers and thus conscious citizens of Ukraine.

"Partnership with Foxtrot enriches our project and expands the circle of followers of the idea of paying taxes honestly," Executive Director of NGO CASE Ukraine Dmytro Boyarchuk said. "We are pleased to find like-minded people at Foxtrot who not only make impressive contributions to the budget and to an improvement in the quality of public services, but also participate in the education of conscious taxpayers, demanding voters."

Conclusions: Valeriy Makovetskiy on the role of taxes and law-abiding business in sustainability of the state

Budget revenue in Ukraine is formed by value-added tax, excise taxes, personal income tax, tax on corporate profits, local taxes, royalties for the use of subsoil assets and rents, import duties, income from capital transactions, funds from international organizations, official transfers and others. The share of taxes on corporate profits at the beginning of 2019 was 30%. Taxes paid by individuals accounted for 23% of the state's income. Information is available here: http://cost.ua/en/budget/revenue/. As one can see, more than half of the money transferred to the budget last year as tax revenue was paid by producers, entrepreneurs and individuals. Does the call make sense? We first pay taxes, and then we control how money from the national budget is spent and we live decently in an independent country.

At the annual Civil Society Organizational Development Forum late in 2018, Valeriy Makovetskiy and Gennady Vykhodtsev received an official message of thanks from NGO CASE Ukraine for their participation in the project and hands-on assistance in shaping active taxpayers in the country.

While commenting in an interview to an information agency on the presentation of the Price of the State project, launched by NGO CASE Ukraine jointly with the Foxtrot brand, Valeriy Makovetskiy said:

"If there are no taxes – there will be nothing. Yes, when there are no taxes, there is no control over them – then come Crimea and Donbas. And if we do not think about it, then we will lose the whole country. This is a challenge, of course, but I think we need to continue working, explaining to people, narrating, and, which is very important, paying taxes and controlling state expenses. We believe in the success of what we have started doing. This work is hard, it requires much attention, but we'll have to do it."