Ukraine's Deposit Guarantee Fund has held an auction to sell a pool of assets belong to OJSC VAB Bank. With the estimated value of the lot being UAH 5.85 billion, the Fund has failed to sell it at even 80% lower, and the only deal was the sale of a plot of land for ... UAH 3,200. Meanwhile, ex-owner of the bank Oleg Bakhmatyuk offered to pay off the bank's debt to the budget in the amount of about UAH 8 billion.

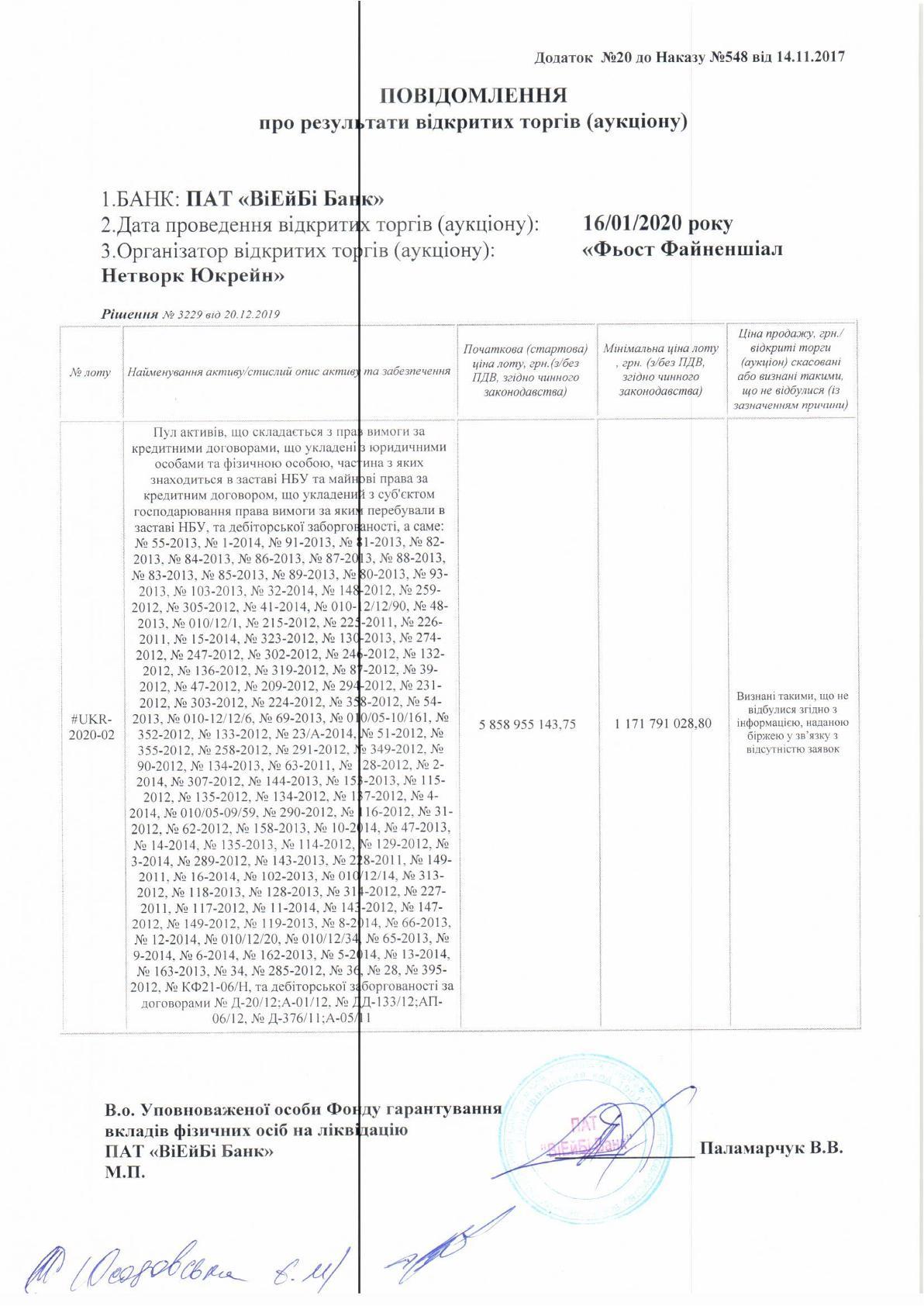

The Dutch model was used during the auction, which was held via LLC First Financial Network Ukraine's platform to sell VAB Bank's assets put up by the Deposit Guarantee Fund for sale. The auction yielded virtually no any results. Buyers showed no interest in the lot consisting of 113 loans and three positions of accounts receivable from agricultural enterprises, including a health center and other property complexes, a confectionery workshop and commercial real estate facility despite the conditions of sale at the lowest price – for UAH 1.17 billion with the starting price set at UAH 5.86 billion.

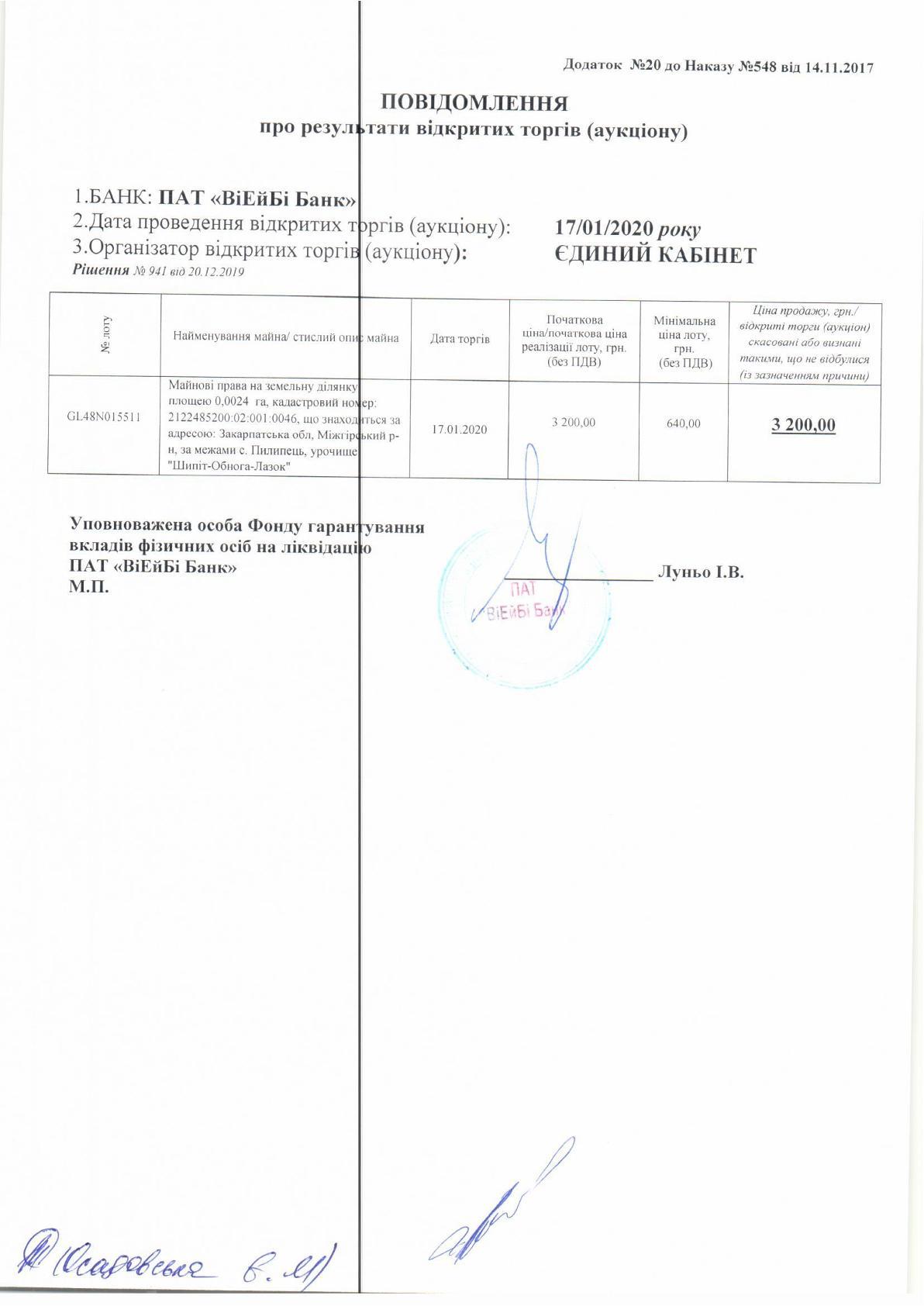

The only deal concluded was the sale of property rights to a plot of land in Zakarpattia region with an area of 0.0024 ha for UAH 3,200. This was announced by the Deposit Guarantee Fund on OJSC VAB Bank's website, the Ukrainian News Agency said.

Meanwhile, the state may have the bank's debts reimbursed in the amount of about UAH 8 billion, which was repeatedly proposed by Oleg Bakhmatyuk, the former owner of VAB Bank, with the use of a restructuring model. Yet, the offer has not yet received a response from the National Bank of Ukraine (NBU) and the Deposit Guarantee Fund.

VAB Bank's credit rating was 'uaAA' (very high reliability in the long run), the bank was withdrawn from the market along with most Ukrainian banks during the so-called Ukrainian banking system's purge – a large-scale campaign to liquidate banks in keeping with the NBU's decision in 2014. Last fall, the National Anti-corruption Bureau of Ukraine (NABU) opened the so-called [NBU First Deputy Governor Oleksandr] Pyrasurk-Bakhmatyuk case, which concerns the alleged misuse of a stabilization loan issued by the NBU to VAB Bank, although the refinancing funds were spent by the bank under the NBU's strict control and on payments to depositors only. VAB Bank's ex-owner himself initiates the repayment of the loan under the procedure agreed with the state.